New Tax Code 2021 (Mar) Read All Vital Information -> This content will share all the details of new tax codes and the implementations in different sectors.

Have you read all the New Tax Code 2021? Are you an individual taxpayer? If yes, there might be no change for you. However, the government has announced different changes in the forms and criteria for tax calculation.

These changes have made the citizens from the United Kingdom, the United States, and India curious to know about the various forms.

These new changes have done well for all the senior citizens. All the business owners are now eager to know about the announcements and changes made in Union Budget that are to be applied from 2021.

What is this New Tax Code 2021 all about?

The government has made some changes in the tax calculation and tax payments. These changes are to be applied from April 6, 2021 but do not apply for all the employees leaving before April 6. According to these new announcements, all the senior citizens who have their earnings only from the pension amounts and the interest on their savings will not have to pay any taxes.

Moreover, the business owners will have to make changes in their tax payments with some pre-filled forms and payments for their newly hired employees, old employees, and those who left the company.

What are the protocols to be followed for the employees who are leaving?

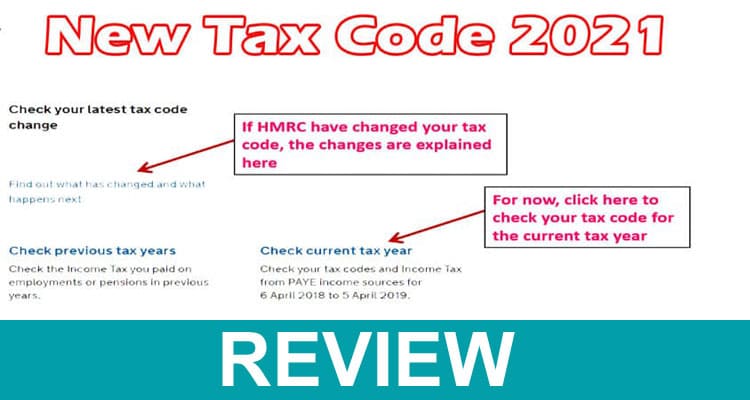

All those who are searching for New Tax Code 2021 online should know that they will receive a new paper form and online notification about any changes. And talking about the employees who are leaving the company before April 6, you will have to use the old tax codes even if you will be paying them after April 6, 2021.

These recent tax codes don’t apply to the employees if you have given P45 to them.

What are the protocols to be followed for the new employees?

It totally depends on the time of hiring. If you are an employer and you have hired an employee between April 6 and May 24, and you are given P45, you should open the official links and follow the instructions.

You can also search for New Tax Code 2021 to learn about the new instructions. And if you prefer manual payroll, you can follow the instructions at RT7.

Final verdict

The government has given some details to these tax payments; you can add 7 to all the tax codes ending with L and add 8 and 6 to the tax codes ending with M and N, respectively.

And the most important change is that the ITR forms will not contain pre-filled information, including the bank interests, dividend income, and more. You can consult with any income tax specialist or type New Tax Code 2021 on google to learn about the new instructions.

Do you own a business? Have you read about the new tax codes and predicted about the changes you will have to make? Please share your viewpoint in the feedback section at the end of this news content.